Jerome Powell, chair of the Federal Reserve, recently announced that the chances of recession are not elevated. Of course, he has access to more data than we do, plus he is an experienced economist. However, we recall that it was not that long ago that Powell was describing the spike in inflation as “transitory.”

Rather than rely on statements from the Fed, here is a simple tool that you can analyze yourself to judge if a recession is coming,

MacroMavens offers a recession predictor that makes common sense and is easy to calculate. The firm recognized that recessions often follow the twin drags of big jumps in long-term interest rates and oil prices.

The economy has headed south whenever the combination of the year-over-year change in Moody’s Seasoned Baa Corporate Bond Yield (BAA) plus the change in oil prices has topped 100%. Barron’s notes that was the case in both the 2000–2001 post-dot-com bust and the 2007–2009 housing bubble.

It makes perfect sense that a big, combined jump in rates and energy prices in a year would be a major shock to the economy, corporations, and consumers on multiple levels. Our research indicated that a combined gain in these two volatile and basic elements of the economy (rates and oil) of more than 85% over a year will cause shock waves to the economy and the markets. For perspective, the CPI (consumer price index) has risen 8.5% over the last 12 months, a 40-year high, impacting consumers, businesses, and the markets.

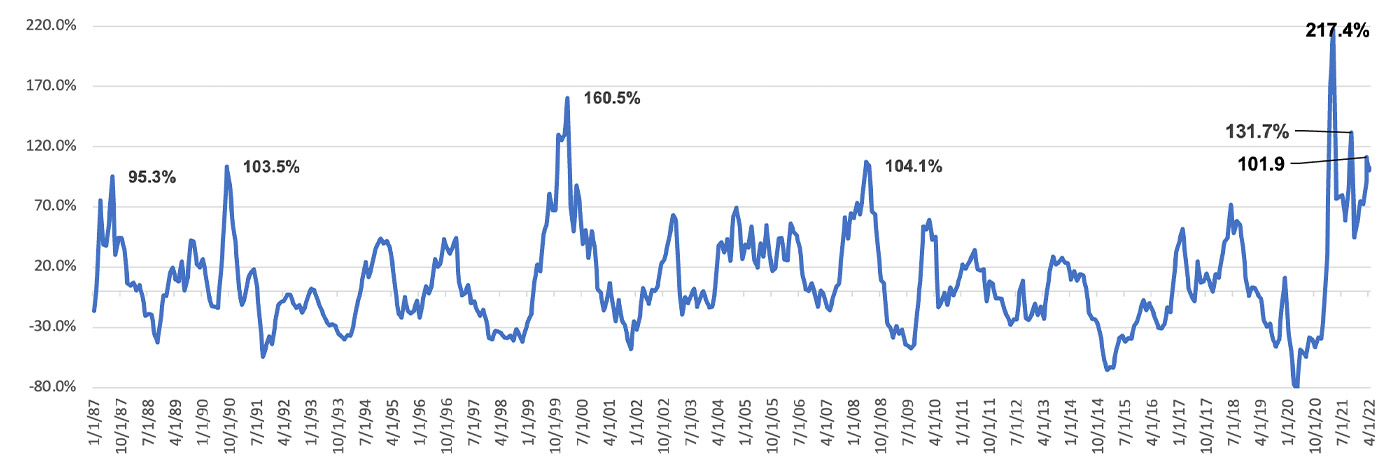

FIGURE 1: HISTORICAL VIEW OF SPIKES IN BOND YIELDS AND OIL PRICES

Sources: STIR Research, based on Federal Reserve economic data, Moody’s Seasoned Baa Corporate Bond Yield, crude oil prices—West Texas Intermediate (WTI)

Looking back over 36 years, the data identified seven cases of combined year-over-year gains in bond yields and oil of over 85%. Occurrences are rare—but so are recessions and bear markets.

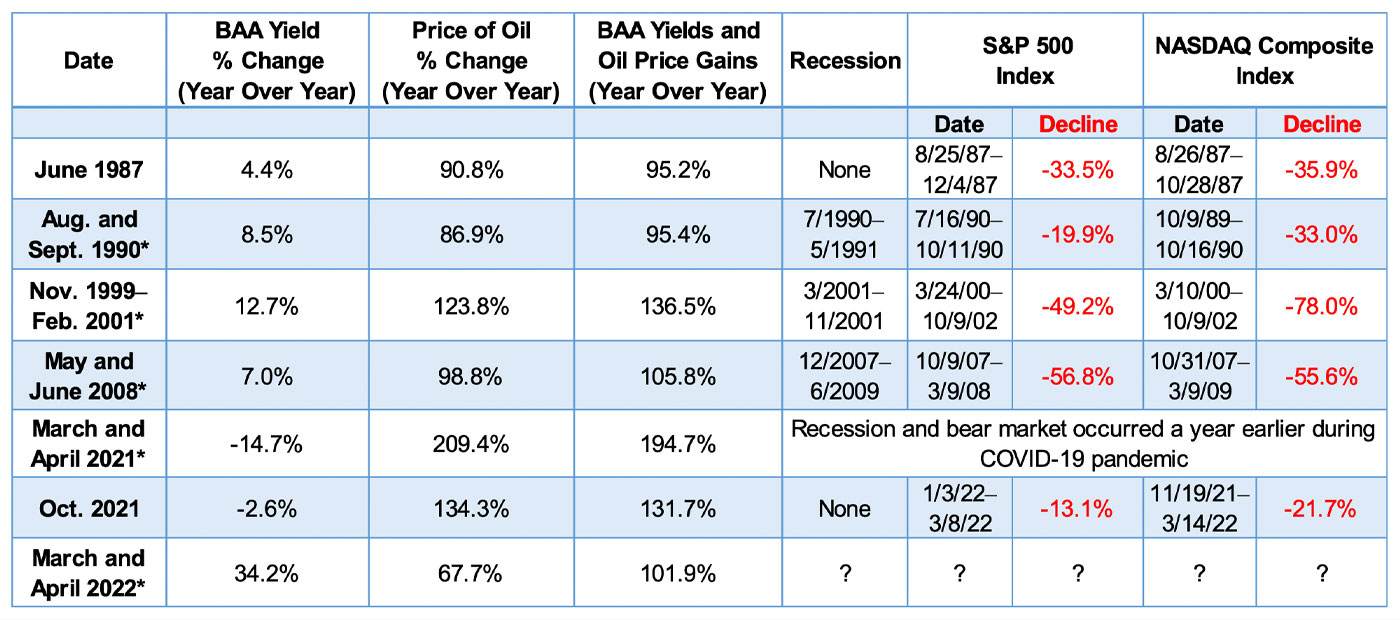

TABLE 1: INSTANCES OF 85%-PLUS COMBINED SPIKES OF BOND YIELDS AND OIL PRICES

*Values represent the average if the time frame is multiple months.

Source: STIR Research

Observations

-

Spikes in interest rates and oil either preceded or occurred during a recession in four out of the last five recessions.

-

Even if a spike in rates and oil did not lead to a recession, ugly bear markets were the norm.

-

The 2020 COVID-19 pandemic led to a sharp recession—and also steep drops in interest rates and oil prices. This period was the only recession and major bear market that this methodology missed.

-

The spike in oil prices in March and April 2021 could be misleading. It followed the collapse in oil prices in 2020 due to the pandemic shutdown policies. In 2019, oil traded in the $60–$70 range, only to fall below $20 in March and April of 2020. As the economy reopened in 2021, oil prices returned to pre-COVID levels. That move back to “normal” created the triple-digit spike in oil prices.

-

After both 2021 spikes, the economy did not slip into recession. Due to the pandemic, government stimulus to the economy was unprecedented, amounting to trillions of dollars. Additionally, BAA yields on a year-over-year comparison were trending down in 2021. The data suggest that it takes the one-two combo of higher interest rates and higher oil prices to spark either a recession or set the stage for a bear market decline.

-

Readings over 85% can occur months or up to over a year ahead of a recession or bear market. Therefore, it is not an entirely accurate market-timing indicator. A better use is simply to make one aware that major trouble for the economy and markets is at an elevated level.

Currently, March and April 2022 are at 100%-plus levels, indicating more trouble could be ahead for the economy and markets. This may not be just a two-month reading. In the coming months, rising yields on BAA corporate debt are going to be compared to falling rates a year ago. Yields fell from 3.6% in March 2021 throughout the summer and into early fall to levels around 3.2% to 3.3%. The current yield for BAA is 4.8% and rising. Oil at the same time last year was trading in the $60s, and now is above $100. If rates and oil stayed at current levels, readings above 85% would remain in place through September.

What should investors do?

The dual spike in yields and oil prices should be viewed as an early warning of a possible recession or bear market. The economy and markets may not be as smooth going forward as many currently predict. Markets will begin to discount the possibility of a recession in advance, as the historical data shows. That should highlight the need to implement a strong plan for defense now, not when the actual recession is upon us.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com